How Rising Mortgage Rates Impact Your Buying Power.

How Total Quality Lending is different.

Many of you may be questioning whether it’s the right time to continue your home search or wait until the storm clears, with the average 30-year fixed mortgage rate inching up to 5% from Freddie Mac. We’re here to tell you the truth of the matter is timing is everything.

You may be tempted to put your plans on hold hoping rates will drop but waiting will only cost you more. Mortgage rates are forecasted to continue to rise for the rest of the year.

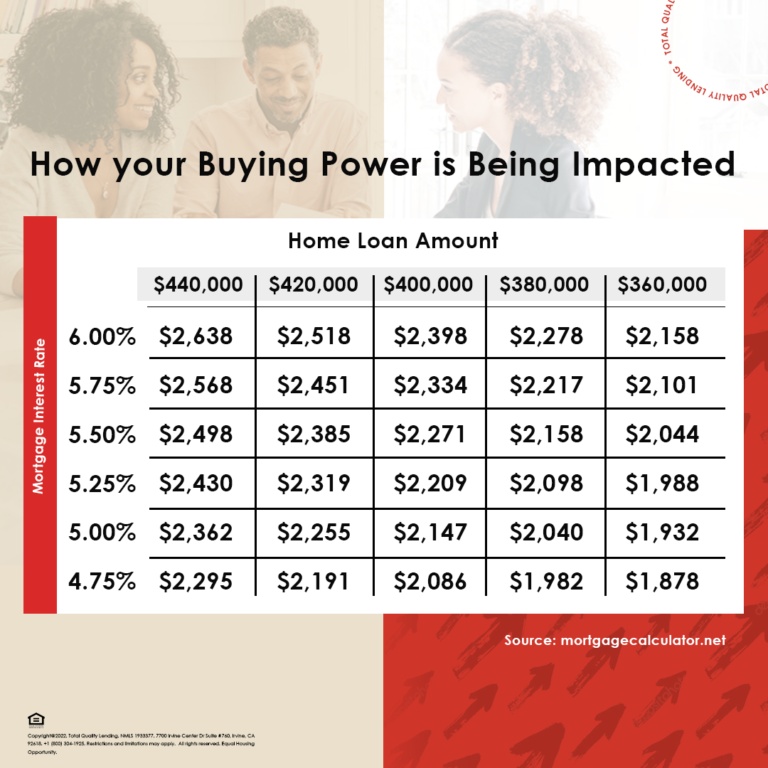

As rates increase, your monthly mortgage payment is impacted and directly affects what you can afford.

How Rates Impact You

Rising mortgage rates play a significant role and impact your home search in a huge way. Expect to see your monthly mortgage increase as rates go up which determines what you can comfortably afford. Even with a quarter-point increase, you can see how your mortgage payment based on your home loan amount is affected.

As mortgage rates rise expect to see your purchasing power impacted. It might be just the right time to stop delaying your plans and use the increase in rates as motivation to purchase your new home before they rise further. Get strategic with your search and plan your next steps accordingly. We always recommend meeting with our team for a prequalification and getting advice on the best ways to get prepared, how to adjust your home search based on your budget, and make sure you act quickly to make an offer.

Rising rates should act as a motivating factor to buy sooner rather than later if it will save you money in the long run. Connecting with our team will help you better understand your budget and how to be prepared to pull the trigger on a home before rates climb even more.

We’re here to tell you although it’s difficult to stick with the home purchase journey in this current climate, you’ll be glad you did. The decision to buy a home now will be worth the effort in the end as you’ll be able to take advantage of the benefits that come with it. Here are a few reasons to stick with your search and focus on the outcome:

Homeownership Contributes Significantly to Your Financial Well-Being

“Money paid to your landlord for rent is money that you’ll never see again, but mortgage payments let you build equity . . . Building equity in your home is a ready-made savings plan.”

The Emotional Benefits of Owning a Home Are Powerful

The home is yours. You can decorate any way you want and choose the types of upgrades and new amenities that appeal to your lifestyle.”

Conclusion

Serious buyers should approach rising rates as a motivating factor to buy sooner, not a reason to wait. Waiting will cost you more in the long run. Let’s connect today so you can better understand your budget and be prepared to buy your home even before rates climb higher.